Mile Tracking App Iphone Review 2017 Excel Quicken Multiple Vehicles

Editor'southward Note - You can trust the integrity of our balanced, independent financial advice. We may, still, receive compensation from the issuers of some products mentioned in this article. Opinions are the author's alone. This content has not been provided by, reviewed, approved or endorsed past any advertiser, unless otherwise noted below.

Personal Capital is a hybrid digital wealth management company. They offer a gratuitous online and mobile personal finance and investment management app. I first found Personal Capital when we went looking for alternatives to Mint, the near widely-known personal finance and budgeting app.

Later testingPersonal Capital for a few months, hither'south a review of my experience.

Before nosotros go any further, permit me point out that since creating a Personal Majuscule account myself, Coin Nether 30 has become an affiliate of the company, meaning nosotros may receive a commission for referring new users. If y'all make up one's mind to bank check information technology out, you're helping support our free content at no cost to you, so thanks!

How Personal Capital works

Personal Capital = Analysis for your spending and your investments.

Personal Capital is showtime and foremost an investing app. Personal Capital aggregates checking accounts and credit cards, likewise, merely information technology'south articulate that their evolution priority is investing, which isn't a bad thing.

Unlike virtually personal finance management programs that brand money by advertizing or recommending products, Personal Capital's concern model is based upon selling investment informational services to a pocket-sized percentage of users.

Personal Capital utilizes a linked depository financial institution business relationship!

To have advantage of Personal Capital, you lot'll demand to "link" 1 or more of your bank and investment accounts (for example, your checking account, IRA, and 401(1000) accounts). This process takes 10 minutes or so, and y'all'll need to have the logins to those accounts handy.

One time you link accounts Personal Capital tin begin to go to work. Here are some of the tools Personal Capital offers.

Tools Personal Capital offers

Portfolio assay

In the allotment tool, the colored rectangles testify the percentage of your portfolio in each nugget class: Cash, international stocks and bonds, US individual stocks or bonds, and alternatives.

Personal Majuscule lets you explore your entire investment portfolio visually, regardless of where you hold the investment avails (Fidelity, TD Ameritrade, your 401k, etc.). I've constitute this valuable for managing my own overall asset allotment.

For example, in the recent stock market place rally, the percentage of stocks I own compared to bonds has ballooned. Personal Capital lets me see simply how much and identify the accounts in which I should sell some stocks and pick up alternative assets. Of course, that'south a basic example – Personal Capital tin can break downwardly your portfolio by industry, marketplace cap, and a host of other variables.

Fee analyzer

With Personal Capital's retirement planner tool, the fee analyzer, yous tin can see how your retirement account fees are impacting your retirement date. They'll also show you any hidden fees in your mutual funds.

Cash menses

Personal Capital includes a full-featured "personal finance manager" (similar to Mint) that automatically aggregates your income and expenses, then displays your cash flow data in easy-to-read charts.

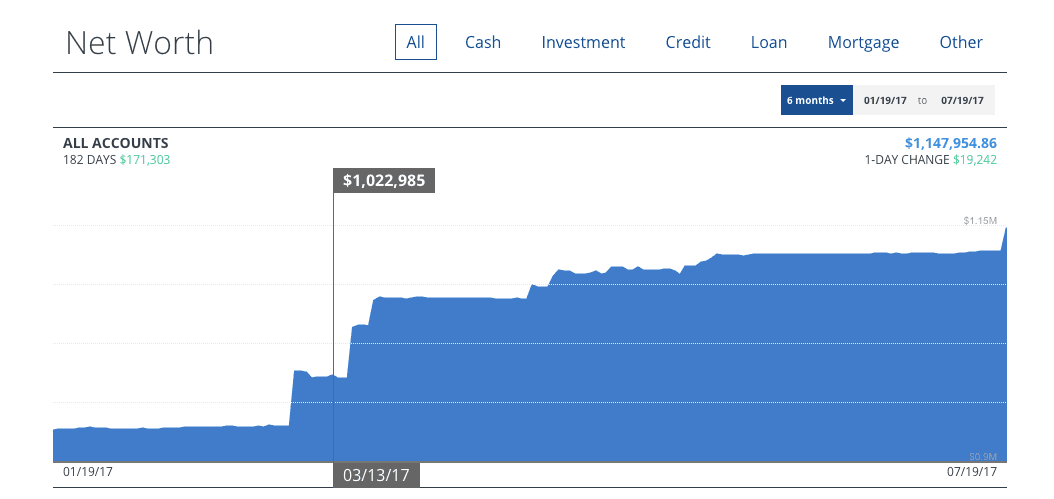

Net worth

What practiced is a financial app if information technology doesn't provide a clear summary of your financial position?

The Personal Capital net worth written report puts your balances, cash flow, and investment holdings in one identify. It also integrates with the real estate website Zillow to provide daily updates on your belongings values.

Read more:Net Worth Is Your Most Vital Financial Stat – Do You lot Know Yours?

Budgeting

Personal Capital includes a budgeting tool, so you can have all your personal finance tools in one app. With the budgeting app you can:

- Set a monthly spending target and track your spending

- Run into your spending and savings by date, category or merchant

To become a ameliorate handle on your coin, open a Personal Capital business relationship today!

Personal Majuscule's investment strategy

Personal Capital really wants y'all to believe that they have your best interest in mind, so they're very open most their investment strategy.

Their strategy is based on years of research, and their goal is to "institute and maintain a strategic investment account portfolio which gives every client the best hazard to achieve their financial goals."

Personalized asset allotment

In Personal Capital's investment strategy they country:

We consider current involvement rates and equity valuations, and their likely bear on on future returns, but uses historical hazard and return data as an objective starting betoken for determining an optimal asset class mix.

What all this ways is they evaluate the market both now and how information technology's performed in the by to brand sure your portfolio is made up of the best possible mix of assets.

To get a better picture, here's a graph to represent their methodology.

Increasing diversification for amend returns

While asset allocation (see higher up) is important, it's also important to option the right securities within the assets.

While information technology may seem counterintuitive, sometimes picking the hottest stocks isn't a great idea in the long run. As you can see from Personal Capital'south graph, having a portfolio based mostly in ane asset course – allow'southward stick with stocks – can hurt if the stock market crashes. That's what Personal Capital helps y'all avoid.

Taxation optimization

Tax optimization is a big office of Personal Majuscule'south investment strategy. Information technology involves utilizing credits or deductions that can exist used to reduce taxes. Personal Capital's "tax optimization process focuses on iii key areas: tax resource allotment, tax-loss harvesting, and tax efficiency."

- Tax allocation: According to Personal Majuscule, "a general rule is to place higher-yield investments in tax-deferred or exempt accounts and depression-yield investments in taxable accounts."

- Revenue enhancement-loss harvesting: This allows yous to potentially pay fewer taxes and increment long-term returns by selling off losing investments.

- Tax efficiency: When it comes to investing, there are a lot of investment vehicles to choose from. Each selection can have different revenue enhancement implications, so agreement which are the most efficient for you can help reduce your taxes.

Read more than:How To Profit From Losing Investments With Revenue enhancement-Loss Harvesting

Personal Uppercase's pricing

The app is free

Using the Personal Upper-case letter app is free because the company hopes to sell a small-scale percent of users' financial informational services. If you take over $100,000 in assets, you'll likely go a telephone call from a Personal Capital advisor offering some friendly communication, but make no mistake, it'southward a sales pitch.

Wealth management services come with fees, but they're worth it

As far as financial advice goes, Personal Capital is taking the right approach. Their fiscal planning services arefee-only, meaning they won't endeavor to sell you expensive investments hidden with commissions and fees.

Rather, you lot pay an annual fee based on the size of your investment portfolio to accept admission to a Personal Capital financial advisor who will provide investment direction and other financial planning services.

Investors pay 0.89% a year on their $ane million of assets nether management (AOM) with Personal Capital. Then it slides down. Here's the full schedule:

- 0.89% on the first $1 million.

For investors who invest $i meg or more:

- 0.79% on the outset $iii million.

- 0.69% on the side by side $2 meg.

- 0.59% on the adjacent $5 million.

- 0.49% over $x meg.

Personal Majuscule'south fee schedule is in line with industry norms, if a little less. To take advantage of the low-fees Personal Uppercase has to offer,schedule a gratuitous consultation today!

Additional services offered by Personal Uppercase

Personal Capital offers more than the to a higher place services. You lot can also inquire to have Personal Capital evaluate the post-obit

Retirement planning

With Personal Upper-case letter's retirement tools you tin can meet when you'll be able to retire, how any large expenses or income increases will bear on your retirement date.

Estate plans

Personal Capital tin help you make decisions regarding your estate. They'll assist brand certain your legal documents are in order and help yous plant a trust if you lot need i.

Home purchases and re-financing

Buying a home is a complicated process. If you're thinking about buying a dwelling for the get-go time, or want to re-finance your loan, Personal Capital also has communication that can help you.

They'll help you lot effigy out how much house you tin can afford, and fifty-fifty assist you get the actual mortgage through their partners Pershing and Bank of New York Mellon. Don't worry, Personal Capital doesn't receive any referral fees, discounts, or other incentives for this referral.

Read more:First-Time Home Buying Guide

College savings

Saving for college requires a lot of planning – Personal Uppercase can help!

They're bachelor to discuss the methods y'all can utilise to fund instruction expenses. Their goal is to help make certain you're saving and paying for higher in the well-nigh revenue enhancement-efficient way.

My experience using Personal Capital

Impressive app

For the virtually part, the Personal Capital user experience is skilful. I've done most of my exploring on my laptop because the richness of their graphical reports lends itself to a bigger than 4-inch screen. As a result, their iPad app is also slick.

Adept security

Like any app that has access to sensitive fiscal information, security is important. Personal Capital has two-cistron authentication, significant that whenever yous log in from an unknown device (or clear your cookies), you'll be required to become a text bulletin or phone call with a Pin that you must enter forth with your countersign.

That can be an inconvenient actress step at times but provides peace of mind that somebody who happens to swipe your login can't view your unabridged financial picture.

P r o south

- Like shooting fish in a barrel-to-use app — No matter what device you use, Personal Majuscule is like shooting fish in a barrel to use.

- Dandy security — Personal Upper-case letter has ii-factor authentication. So whenever yous log in from an unknown device, you'll get a text message or phone call with a PIN that you must enter along with your countersign.

- The app is complimentary — While you do have to pay some fees if you have Personal Capital manage your money, the app itself is completely free to utilize.

C o due north s

- Wealth Management Fees — Personal Capital requires some hefty fees for its wealth management services. Just in our opinion, they're worth it. Plus, their regular budgeting tools are completely free.

- Solicitation later reaching $100,000 benchmark — Personal Majuscule may accomplish out to its users to effort and sell their wealth direction service. This is more common later on users reach $100,000 in their account. This can exist an annoyance for some users.

Personal Capital vs. Wealthfront

| Personal Upper-case letter | Wealthfront | |

|---|---|---|

| Fees | 0.89% | 0.25% annual advisory fee |

| Minimum investment | $100,000+ | $500 |

| Accounts offered | Roth, traditional, rollover and SEP IRAs; trusts | Individual and joint accounts; IRAs; trusts; 529 plans |

If you want an alternative to compare to Personal Capital letter, I recommend checking out Wealthfront. Like Personal Upper-case letter, Wealthfront is a web-based investment service with an all-in-one money app. However, considering Wealthfront is entirely engineering-based it comes with lower fees (0.25% for an annual informational fee).

While Personal Capital tin can exist a swell choice for anyone, it tends to target those individuals looking for more of a human being touch on. On the other hand, Wealthfront is all about the engineering science – and these days, in that location are many people that prefer this strategy.

If you are in the process of trying to choose a money management and investing app, it's definitely worth comparing a few different options. Wealthfront offers a number of really helpful services including its automation services. Wealthfront offers something called Self-Driving Money ™ . Basically, Wealthfront volition monitor your greenbacks flow into your Wealthfront Cash Account and ensure your bills are paid and can fifty-fifty directly your savings to the right investment accounts based on your pre-gear up goals.

When it comes to investing, y'all tin use Wealthfront to build an individualized portfolio from scratch. Yous tin can cull from a collection of ETFs that were selected and vetted by the Wealthfront enquiry team. Or, to keep it simple, y'all tin use one of Wealthfront'due south existing portfolios and then add together and delete ETFs based on your preference. The bottom line is that Wealthfront is another astonishing coin app that you can check out if you lot're interested in taking command of your money.

Summary

Personal Capital'due south gratuitous portfolio assay tool is a must-endeavour for anyone looking to better understand your holdings, especially if you have more than 1 at more than one broker.

Over the years, I've used and tested dozens of unlike personal finance apps, but nearly lose their novelty after a while. I keep coming back to Personal Upper-case letter considering it's the i plan I've found that gives me insight into my entire investing portfolio, which is spread across several different brokers. The net worth dashboard is also a great mode to see an approximation of my net worth without manually updating a spreadsheet.

Paired with the many other features offers, they truly are the for many immature and experienced investors alike.

Create a gratis Personal Capital letter account and meet for yourself.

Featured image: NicoElNino/Shutterstock.com

Read more:

- v Easy Ways To Kickoff Investing With Little Money

- How To Invest: The Smart Way To Make Your Money Grow

Related Tools

Save Your First - Or NEXT - $100,000

Sign Up for free weekly money tips to help yous earn and save more

We commit to never sharing or selling your personal information.

Source: https://www.moneyunder30.com/personal-capital-review

Belum ada Komentar untuk "Mile Tracking App Iphone Review 2017 Excel Quicken Multiple Vehicles"

Posting Komentar